Choosing the right tenant is one of the most important parts of being a landlord. Learning how to screen tenants can help you avoid problems like late rent, property damage, or evictions. A good screening process lets you find renters who are responsible, pay on time, and treat your property with care.

In this guide, we’ll walk you through a professional, step-by-step approach to tenant screening so you can protect your investment and run your rental business with confidence.

Tenant Screening Steps Every Landlord Should Follow

Knowing how to screen tenants effectively is crucial for minimizing risks and maintaining a successful rental business. Here are the essential steps every landlord should take when evaluating prospective renters.

1. Pre-Screening During Inquiry

Before diving into applications and documents, start with a pre-screening process. Ask potential tenants a few essential questions over the phone or via email to gauge their fit. Inquire about their move-in timeline, employment, pets, and why they are leaving their current residence. This helps narrow down serious applicants and saves time.

2. Require a Rental Application

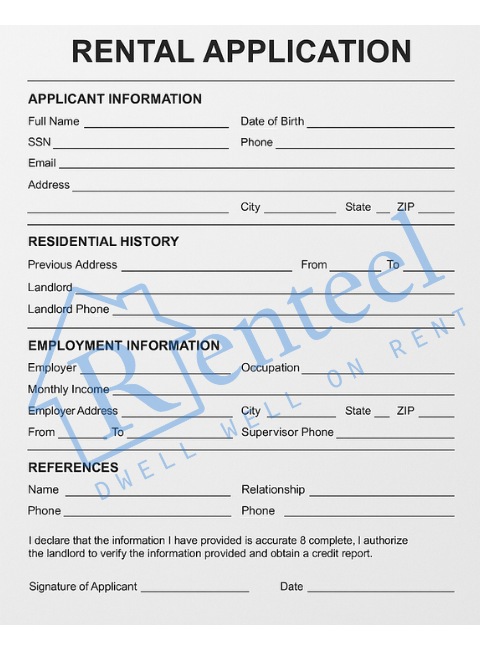

A detailed rental application is essential for an effective tenant screening process. It should capture key personal information such as full name and contact details, along with a complete rental history to evaluate the applicant’s previous behavior with landlords. Here’s what to look for in a rental application:

- Full name, contact info, and Social Security number

- Employment and income details

- Rental history (at least two previous addresses)

- Personal references

Only ask for information that is relevant to the leasing decision to protect privacy and ensure legal compliance. Using a standardized application form helps simplify the process and ensures consistency when comparing applicants.

3. Run Background and Credit Checks

Verifying a tenant’s background is critical. This includes checking criminal records, past evictions, and credit history. A credit report reveals how financially responsible an applicant is—look for consistent bill payments, a reasonable debt-to-income ratio, and any red flags like collections or bankruptcies.

4. Confirm Employment and Income

A clean credit report is helpful, but it’s also important to confirm that the applicant has stable income. Stable income is key to ensuring they can pay rent consistently. To verify income, you can request recent pay slips or bank statements. This process helps ensure the applicant meets your income requirements.

5. Meet the Tenant in Person

No guide on how to screen tenants is complete without an in-person meeting. Whether it’s a property tour or an informal conversation, this interaction gives you insight into the tenant’s personality, professionalism, and communication style. While instincts are important, always pair them with solid documentation.

Final Words

Screening potential tenants is a critical part of managing a successful rental property. By carefully reviewing applications, checking credit and background information, verifying income, and contacting previous landlords, you can greatly improve your chances of finding responsible, long-term tenants. While the process takes time and attention to detail, it helps protect your investment and ensures a more positive rental experience.

If you’d prefer expert help, contact us for complete property management services. We handle everything from tenant screening to maintenance and rent collection, so you can enjoy hassle-free ownership.