Property tax in India is one of the most significant civic duties for homeowners, landlords, and commercial property holders. It is a recurring tax levied by local municipal bodies to fund essential services such as road maintenance, sanitation, sewage systems, and street lighting. Timely payment of property tax ensures the smooth functioning of the city infrastructure while also keeping you compliant with local regulations.

In this all-encompassing guide, we’ll take you through everything you need to know about Property Tax in India, covering its importance, how it’s calculated, the payment process, and any exemptions you might qualify for.

What is Property Tax in India?

Property Tax in India is a local tax that municipal corporations or local governing bodies impose on property owners. This tax helps fund essential public infrastructure and services, including roads, sewage systems, street lighting, and waste management. It applies to all types of properties—residential, commercial, and industrial—and is mandatory for every property owner.

The rules surrounding Property Tax in India can differ from one state to another, as local authorities set their own rates and collection methods. It’s crucial to pay this tax on time, as failing to do so could lead to fines or even legal trouble.

Who is Required to Pay Property Tax in India?

Any person or organization that owns a property in India is liable to pay Property Tax in India. This includes:

- Individual homeowners

- Real estate investors

- Businesses owning office or retail spaces

- Institutions like schools and hospitals

Even if the property is rented out, the property owner remains responsible for paying the tax.

How is Property Tax in India Calculated?

The calculation of Property Tax in India depends on several factors, which may include:

- Area of the Property – Larger properties attract higher taxes.

- Location – Properties in urban or metro areas typically have higher rates.

- Type of Property – Residential, commercial, or industrial classifications influence the tax.

- Age of the Property – Newer buildings may have different rates than older ones.

- Usage – Properties used for business or commercial purposes are taxed at a higher rate.

Some municipalities calculate property tax based on the Annual Rental Value (ARV) or Unit Area System, while others use the Capital Value System.

It’s advisable to check with your local municipal corporation or tax office to understand how Property Tax in India is computed in your area.

Documents Required for Property Tax in India

When registering or updating your property details, you may need the following documents:

- Proof of ownership (title deed or sale deed)

- Property identification number (if available)

- Address proof

- Identity proof (Aadhar card, PAN card, etc.)

- Building plan approval documents

- Previous tax receipts, if applicable

Having all these documents in place ensures that your property tax assessment is accurate and prevents delays.

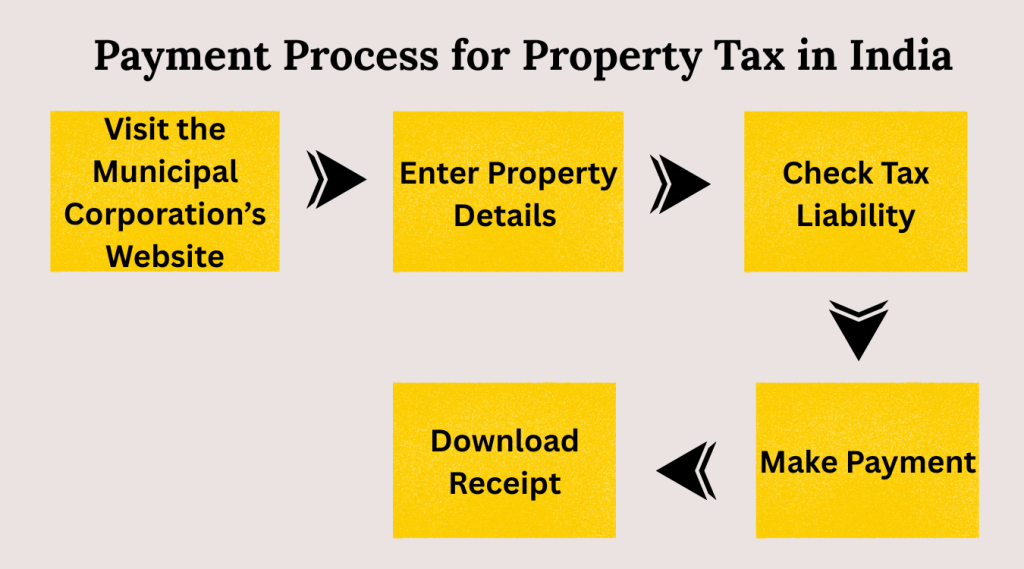

Payment Process for Property Tax in India

You can pay Property Tax in India either offline or online, depending on your municipality. Follow these steps:

- Visit the Municipal Corporation’s Website – Most cities provide online portals where you can pay your property tax.

- Enter Property Details – You need to provide your Property ID or address.

- Check Tax Liability – The portal will show you the tax amount you owe.

- Make Payment – You can complete the payment using net banking, debit/credit cards, or UPI.

- Download Receipt – After you pay, the portal generates a digital receipt for you to download and keep as proof.

Offline payment involves visiting the local tax office and filling out the required forms along with the necessary documents.

Penalties for Non-Payment

Failing to pay Property Tax in India on time can lead to penalties such as:

- Additional fines or interest on unpaid amounts

- Legal action or property seizure in extreme cases

- Disconnection of services like water and electricity

Therefore, it’s crucial to stay updated with deadlines and ensure timely payment.

Exemptions and Rebates Under Property Tax in India

Certain categories of taxpayers may be eligible for exemptions or rebates:

- Senior Citizens – Some municipalities provide tax concessions to elderly homeowners.

- Government Buildings – Public institutions and government-owned properties are often exempt.

- Non-Profit Organizations – Charitable institutions may receive tax benefits.

- Environment-Friendly Buildings – Properties with eco-friendly designs may qualify for rebates in some areas.

It’s best to check with local authorities about available exemptions to ensure you maximize the benefits under Property Tax in India.

Importance of Property Tax in India

Paying Property Tax in India is not just a legal obligation but also a civic responsibility. It funds essential infrastructure that benefits all residents. Well-maintained roads, better drainage systems, parks, and streetlights are all possible because of property tax collections.

Moreover, accurate property tax records can:

- Serve as proof of property ownership

- Help with loan approvals

- Assist in property valuation during sales or inheritance transfers

Recent Changes in Property Tax in India

Several states and local governments are stepping up their game in tax collection by embracing digital platforms. A lot of cities are rolling out smart systems that leverage GIS mapping and automated assessments to make sure tax billing is spot on. Local governments frequently share updates about Property Tax in India, so it’s a good idea for property owners to stay informed.

In some areas, there’s also a push to link property tax payments with income tax returns or to offer convenient payment options through mobile apps.

Conclusion

Understanding property tax in India is crucial for homeowners, investors, and businesses. When you have the right documentation, accurate calculations, and make timely payments, navigating property tax compliance can be a breeze. Plus, knowing about exemptions, rebates, and various payment options helps you make smart financial choices.

In our digital world, keeping up with the latest regulations and utilizing online portals for property tax in India can save you time, minimize mistakes, and help you steer clear of penalties. Whether you’re purchasing your first home or looking to grow your property portfolio, having a solid grasp of property tax in India is essential.